Texas' title loan regulations protect borrowers by capping APRs, mandating transparent disclosures, and ensuring fair repossession processes for vehicle collateral loans. These rules safeguard Texans from predatory lending practices, especially for semi-truck, motorcycle, or bad credit loans, emphasizing the importance of reading loan agreements to understand rights and fees.

In Texas, understanding your rights as a borrower is crucial when navigating the state’s unique title loan regulations. This article guides Texans through the intricacies of their protections under Texas lending laws. We explore how current regulations in title loan practices safeguard borrowers from predatory lending, ensuring fair terms and transparent agreements. Learn about your rights, the enforcement process, and practical steps to ensure a secure borrowing experience within the framework of Texas title loan regulations.

- Understanding Texas Title Loan Laws

- Borrower Protections in Lending Practices

- Enforcing Your Rights: A Guide for Texans

Understanding Texas Title Loan Laws

In Texas, understanding the title loan regulations is crucial for borrowers looking to access short-term financing secured by their vehicles. The state has specific laws in place to protect consumers and ensure fair lending practices when it comes to title loans, which are a type of secured loan using a vehicle as collateral. These regulations cover various aspects, including interest rates, loan terms, and the rights of borrowers during the entire process.

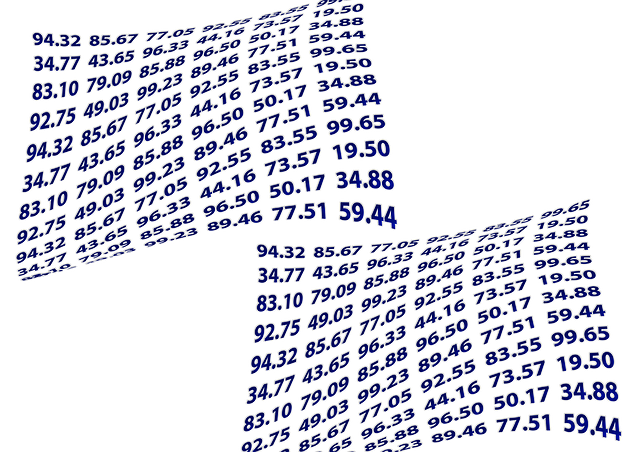

Borrowers should be aware that Texas has strict guidelines on the maximum interest rates allowed for title loans, often referred to as ‘title loan regulations’. These rules help prevent predatory lending by capping the annual percentage rate (APR), ensuring that lenders cannot charge excessively high fees. Additionally, the state requires transparent disclosure of loan terms, including the total cost of borrowing, giving borrowers a clear understanding of their financial obligations. When taking out a title loan, individuals have the right to retain possession of their vehicle and receive fair treatment throughout the repayment period.

Borrower Protections in Lending Practices

In Texas, borrower protections are a critical aspect of lending practices, particularly when it comes to Title Loan regulations. The state has put in place measures to ensure that lenders operate fairly and transparently, shielding borrowers from predatory practices. These protections include clear disclosure requirements, which mandate that lenders provide comprehensive information about loan terms, interest rates, and potential fees. Borrowers have the right to understand fully what they are agreeing to, enabling them to make informed decisions regarding their financial commitments.

Moreover, Texas law offers safeguards for borrowers who use vehicle collateral for fast cash loans. Lenders must adhere to specific rules when repossessing vehicles, ensuring that the process is conducted fairly and in accordance with state laws. Additionally, direct deposit of loan proceeds is a common practice, offering borrowers convenient access to their funds, further enhancing transparency and timely access to financial resources.

Enforcing Your Rights: A Guide for Texans

In Texas, borrowers are protected by stringent Title Loan Regulations designed to ensure fair lending practices. These regulations are in place to safeguard Texans from predatory lending behaviors and abusive terms. Understanding your rights under these laws is crucial when considering any type of loan, including Semi Truck Loans, Motorcycle Title Loans, or Bad Credit Loans.

When enforcing your rights, borrowers should be aware of their entitlements regarding interest rates, repayment terms, and collection practices. Texas law limits the annual percentage rate (APR) for title loans, ensuring that lenders cannot charge excessive interest. Additionally, borrowers have the right to cancel the loan within a specific timeframe, allowing them to change their minds without penalties. It’s important to read and understand the loan agreement before signing, as it should clearly outline these rights and any associated fees.

In Texas, understanding and protecting your borrower rights is essential when it comes to title loan regulations. By being aware of state laws and the safeguards in place, you can make informed decisions and navigate lending practices with confidence. Remember that these protections are designed to foster fair and transparent transactions, ensuring Texans have a clear path to accessing short-term financing while safeguarding their rights throughout the process.